Betsy a recent retiree requires – Betsy, a recent retiree, embarks on a new adventure filled with possibilities and challenges. This guide is her trusted companion, providing insights, strategies, and inspiration to help her thrive in this exciting phase of life.

Retirement marks a significant transition, bringing forth financial considerations, healthcare decisions, lifestyle adjustments, and opportunities for personal growth. Join Betsy as we delve into each aspect, empowering her to make informed choices and live a fulfilling retirement.

Financial Planning for Retirement: Betsy A Recent Retiree Requires

Planning for retirement involves ensuring financial stability and security during the golden years. A well-crafted financial plan can help retirees manage their income and expenses effectively, make informed investment decisions, and create a retirement budget that aligns with their goals and aspirations.

Managing Income and Expenses

Upon retirement, income sources may change significantly. Retirees may receive pension benefits, Social Security payments, and withdrawals from retirement accounts. It is essential to estimate these sources of income accurately and plan expenses accordingly. Expenses in retirement may include housing, healthcare, transportation, and leisure activities.

Creating a detailed budget that Artikels income and expenses can help retirees track their cash flow and make adjustments as needed.

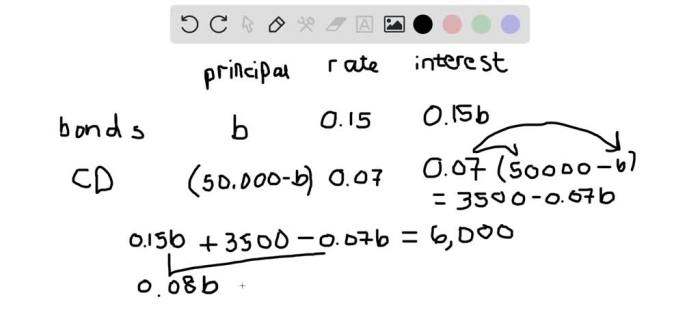

Investment Options and Risk Tolerance

Investment decisions during retirement should be guided by risk tolerance and financial goals. Retirees may consider a mix of investments, such as stocks, bonds, and real estate, to diversify their portfolio and manage risk. It is important to assess risk tolerance, which refers to the level of potential loss an individual is willing to accept in pursuit of higher returns.

A financial advisor can assist in creating a personalized investment plan that aligns with individual circumstances and risk tolerance.

Creating a Retirement Budget

A comprehensive retirement budget serves as a roadmap for managing finances during retirement. It should include both fixed expenses (e.g., housing, healthcare) and variable expenses (e.g., travel, entertainment). By creating a realistic budget, retirees can ensure that their income covers their expenses and that they can maintain their desired lifestyle in retirement.

Healthcare Considerations

Healthcare is a crucial aspect of retirement planning, as medical expenses can be significant. Understanding the available options and planning for potential healthcare costs is essential.Medicare, the federal health insurance program for individuals aged 65 and older, provides coverage for hospital stays, doctor visits, and other medical services.

However, it does not cover all expenses, and additional insurance may be necessary. Options include Medicare Advantage plans, which offer comprehensive coverage, and Medigap plans, which supplement Original Medicare.Long-term care planning is also important, as the need for assistance with daily activities can arise in later years.

Long-term care insurance can help cover these costs, which can be substantial. Alternatively, Medicaid may provide coverage for long-term care expenses for those who meet certain income and asset requirements.Maintaining a healthy lifestyle in retirement can help reduce healthcare costs and improve overall well-being.

Regular exercise, a balanced diet, and preventive care can contribute to longevity and reduce the risk of chronic diseases.

Medicare and Other Health Insurance Options

Medicare provides basic health coverage for seniors, but it may not cover all expenses. Consider the following additional insurance options:

- Medicare Advantage Plans:These plans offer comprehensive coverage, including prescription drug coverage, for a monthly premium.

- Medigap Plans:These plans supplement Original Medicare, covering deductibles and copayments.

- Private Health Insurance:Some individuals may choose to purchase private health insurance to cover expenses not covered by Medicare or other plans.

Long-Term Care Planning and Costs

Long-term care can involve assistance with daily activities such as bathing, dressing, and eating. The costs can be significant, and planning is crucial.

- Long-Term Care Insurance:This insurance can help cover the costs of long-term care services, including nursing home care, assisted living, and home health care.

- Medicaid:This government program provides coverage for long-term care expenses for those who meet certain income and asset requirements.

- Personal Savings:Setting aside savings specifically for long-term care expenses can help offset the costs.

Strategies for Staying Healthy and Active in Retirement

Maintaining a healthy lifestyle in retirement can help reduce healthcare costs and improve overall well-being.

- Regular Exercise:Aim for at least 150 minutes of moderate-intensity exercise or 75 minutes of vigorous-intensity exercise per week.

- Balanced Diet:Choose a diet rich in fruits, vegetables, and whole grains, and limit processed foods, sugary drinks, and unhealthy fats.

- Preventive Care:Regular check-ups, screenings, and immunizations can help detect and prevent health issues early on.

Housing Options

Retirement presents a unique opportunity to explore different housing options that align with your lifestyle, financial situation, and personal preferences. Whether you choose to own or rent, there are various factors to consider to make an informed decision.

Betsy, a recent retiree, requires a reliable storage solution for her precious memories. She has stumbled upon the primary master pata hard disk , renowned for its durability and spacious capacity. Betsy believes that this storage device will be the perfect companion for preserving her cherished photos, videos, and documents, ensuring that her memories will remain safe and accessible for years to come.

Factors to Consider When Choosing a Retirement Home

*

-*Location

Proximity to amenities, healthcare facilities, and social activities can significantly impact your quality of life.

-

-*Size and Layout

Consider the number of rooms, bathrooms, and overall space you need. Accessibility and safety features are also important.

-*Cost

Factor in mortgage payments, property taxes, maintenance costs, and potential repairs when considering homeownership.

-*Lifestyle

Determine if you prefer a quiet neighborhood, an active community, or a more urban setting.

-*Future Needs

Anticipate any potential changes in your health or mobility that may require specific housing modifications.

Homeownership vs. Renting

Homeownership:*

-*Benefits

Potential for appreciation, tax benefits, and the satisfaction of owning your own property.

-*Considerations

Financial responsibility, maintenance costs, and potential property value fluctuations.

Renting:*

-*Benefits

Flexibility, lower upfront costs, and no maintenance responsibilities.

-*Considerations

Rent increases, limited customization options, and potential landlord issues.

Lifestyle Changes

Retirement is a significant life transition that brings about both emotional and social adjustments. Understanding these changes and developing strategies to navigate them can enhance your overall well-being and make this new chapter fulfilling.

Emotional Adjustments

- Loss of Identity:Retirement can challenge your sense of purpose and identity, as it disrupts the daily structure and routines that defined your working life.

- Boredom and Loneliness:The absence of a structured work environment can lead to feelings of boredom and loneliness, especially if you’re not engaged in meaningful activities.

- Financial Concerns:Retirement can raise concerns about financial security, particularly if you haven’t adequately planned for your post-work life.

- Health Concerns:Retirement can be a time when health issues become more prevalent, requiring adjustments to your lifestyle and activities.

Finding Purpose and Fulfillment

Discovering new sources of purpose and fulfillment is essential for a satisfying retirement. Consider these strategies:

- Explore Your Interests:Pursue activities that bring you joy and satisfaction, whether it’s painting, gardening, volunteering, or learning a new skill.

- Engage in Social Activities:Join clubs, attend classes, or participate in community events to connect with like-minded people and build new relationships.

- Travel and Explore:Expand your horizons by traveling to new places, experiencing different cultures, and creating lasting memories.

- Give Back to Your Community:Volunteer your time and skills to make a difference in your community and find meaning in your retirement.

Staying Connected

Maintaining strong connections with family and friends is crucial for your well-being in retirement. Here are some tips:

- Schedule Regular Visits:Make an effort to visit loved ones regularly, whether it’s in person, via video calls, or through social media.

- Join Social Groups:Engage in activities that allow you to connect with people who share your interests and values.

- Embrace Technology:Use technology to stay in touch with loved ones who live far away or have limited mobility.

- Foster New Relationships:Don’t hesitate to reach out and make new friends in your community or through retirement groups.

Travel and Leisure

Retirement presents a golden opportunity to indulge in long-cherished travel dreams and explore the world at your own pace. Designing an itinerary for a dream retirement trip is an exciting endeavor that can help you make the most of this new chapter in your life.

Dream Retirement Trip Itinerary

Consider your interests, budget, and physical abilities when planning your dream retirement trip. Whether you prefer adventurous escapades or leisurely cultural immersions, tailor your itinerary to create an unforgettable experience. Allow ample time for each destination, factoring in rest days and unexpected delays.

Remember, the journey is just as important as the destination.

Affordable Travel Destinations for Retirees

Numerous destinations offer affordable travel options for retirees. Consider Southeast Asia, where countries like Thailand, Vietnam, and Indonesia provide a rich cultural experience at a budget-friendly cost. Eastern Europe, with its charming cities and historical landmarks, is another excellent option.

Research and compare destinations to find the perfect fit for your interests and budget.

Budget for Travel and Leisure Activities

Creating a realistic budget for travel and leisure activities is crucial. Estimate expenses such as transportation, accommodation, food, activities, and incidentals. Consider using travel rewards programs, discounts for seniors, and off-season travel to save money. Flexibility in your itinerary and willingness to explore less-visited destinations can also help you stretch your travel budget further.

Estate Planning

Estate planning is the process of organizing your assets and providing instructions on how they should be distributed after your death. It helps ensure your wishes are respected, your loved ones are taken care of, and your assets are managed according to your preferences.

There are several types of estate planning documents, including wills, trusts, and powers of attorney. A will is a legal document that Artikels your wishes for the distribution of your assets after your death. A trust is a legal entity that holds and manages your assets according to your instructions.

A power of attorney is a document that gives someone else the authority to make decisions on your behalf if you become incapacitated.

Creating a Will, Betsy a recent retiree requires

Creating a will is an important part of estate planning. It allows you to specify how your assets will be distributed after your death and to appoint an executor to carry out your wishes.

- Determine your assets:Make a list of all your assets, including real estate, bank accounts, investments, and personal belongings.

- Decide how you want your assets distributed:Consider who you want to inherit your assets and in what proportions.

- Choose an executor:Select someone you trust to carry out your wishes and administer your estate.

- Write your will:You can write your own will or hire an attorney to help you.

- Sign and witness your will:Your will must be signed in the presence of two witnesses.

Creating a Trust

A trust is a legal entity that holds and manages your assets according to your instructions. Trusts can be used for a variety of purposes, such as managing your assets during your lifetime, providing for your loved ones after your death, or reducing estate taxes.

- Determine the purpose of your trust:Decide what you want your trust to accomplish.

- Choose a trustee:Select someone you trust to manage your assets according to your instructions.

- Create a trust document:You can create a trust document yourself or hire an attorney to help you.

- Fund your trust:Transfer your assets to the trust.

FAQ Insights

What are some common financial challenges retirees face?

Managing expenses, generating income, and navigating investment options can pose challenges. This guide offers strategies for budgeting, maximizing savings, and reducing financial stress.

How can retirees stay healthy and active?

Maintaining a healthy lifestyle is crucial in retirement. This guide provides tips for staying physically and mentally fit, including exercise routines, nutrition advice, and strategies for preventing chronic diseases.

What are the emotional and social adjustments retirees need to be aware of?

Retirement can bring about significant changes in identity and routine. This guide explores the emotional challenges and offers strategies for finding purpose, staying connected, and maintaining a fulfilling social life.